Duplicate Invoice Analytics

Duplicate Invoice Analytics

Duplicate invoices should be identified as part of your audit analytics program to determine if the company being invoiced is paying for services or products they’ve already paid for. The company sending the invoice could be doing it maliciously to get paid twice for the same work performed or product sold or it could be an honest mistake on their behalf. Either way, identifying duplicate invoices should be standard practice to provide assurance that you aren’t incurring unnecessary costs.

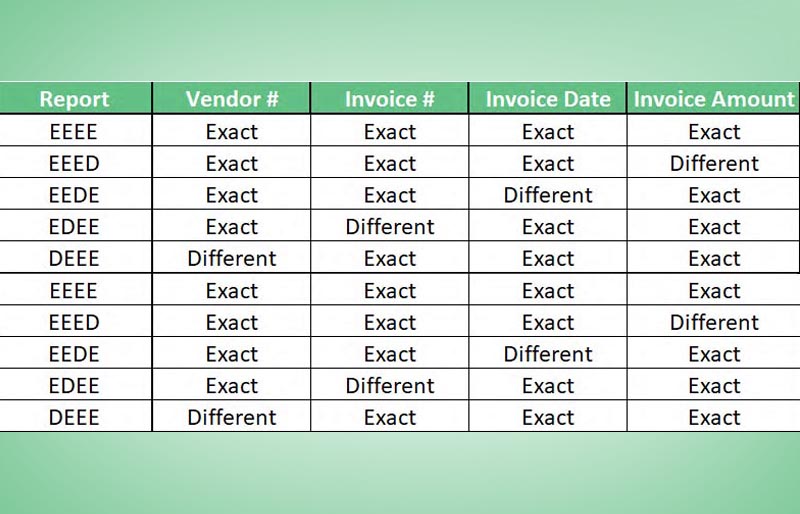

| Report | Vendor # | Invoice # | Invoice Date | Invoice Amount |

|---|---|---|---|---|

| EEEE | Exact | Exact | Exact | Exact |

| EEED | Exact | Exact | Exact | Different |

| EEDE | Exact | Exact | Different | Exact |

| EDEE | Exact | Different | Exact | Exact |

| DEEE | Different | Exact | Exact | Exact |

The basics of identifying duplicate invoices are summarized in the table above. However, just because an invoice has these same characteristics doesn’t automatically mean it’s a true duplicate invoice. For example, with the EDEE test you’ve identified an invoice from the same vendor, with a different invoice number, on the same date, for the same amount. This could be a true duplicate or it could be a scenario where different departments in your company ordered the same four laptops from the same vendor and just happened to have been invoiced on the same date.

This is the next step of testing duplicate invoices. It involves applying your judgement as an auditor and reviewing the supporting documentation, inquiring of management, and reconciling what was invoiced to what was actually received (i.e., physically seeing the same four laptops in both departments).

Running the five reports noted above simply gives you a population of invoices to investigate to determine if they’re truly duplicates. You still need to do the investigation similar to any other audit procedure.

To take duplicate invoice testing a step further would be to look for where the characteristics are similar, but not identical. For example, if an invoice # is “456789” and the vendor, date and amount are the same for invoice number “A456789” then this could be a duplicate invoice you’d consider for investigation. You could also look for invoices that have the same vendor, invoice #, date, and where the amounts within +/-2.5% of each other.

Something to keep in mind if you aren’t using vendor #’s and instead only have vendor name: “Dell”, “Dell Inc” and “Dell Inc.” would need to be cleansed and made uniform; otherwise, they’ll appear as being different vendors in your analysis. Using this audit test in conjunction with other vendor tests, such as trending on the percentage increase of invoices over time per vendor, can create a continuous monitoring process. By aggregating the results of various audit analytics tests we might see where the same vendor is in each population and take a deep dive into that particular vendor as a consultative audit.